For an entrepreneur, the goal of entering new markets is to find more customers, increase turnover and, as a result, increase net profit. Before the start of expansion, you demand to consider carefully the strategy, analyze the market, make a tactical plan and set realistic goals. Otherwise, the exit will be chaotic, and there will be more risks of losing. Today, we will look at how to build a go-to-market strategy in eight steps.

The First Step. Problem Definition and Analysis

The idea seems to be obvious. You need to identify the problem before you start making changes. However, many often either skip this step or highlight an insufficiently serious and acute problem. It can be either one person or a small group of people who analyze the development trends of the industry, country, world and understand what can happen to the company and what problems it already has now, what problems may still come in the future if we do not start changing. The ideal option is when the top manager of the company explains in detail the problem, the current alignment of forces and the future state that needs to be reached in order to avoid losses associated with the problem. At this step, it is enough for the leader to enlist the support of several of his closest managers.

The Second Step. Study the Demand and Audience

As a rule, for effective sales in a new market, even a successful product has to be modified to meet the needs of buyers. Find out who will be the typical representative of your target audience in the new market: make a general portrait of the consumer, his or her habits, and needs. There are several ways to find answers to these questions:

1. Conduct a survey. Find dozens of potential customers and interview them. Try not to ask direct questions.

2. Use search engines. Take search services to see how often users searched for phrases that match your product during the year.

The Third Step. Assess the Competition

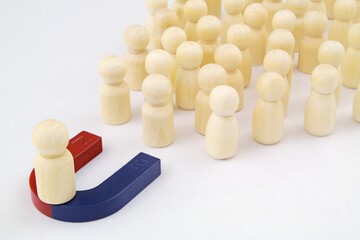

When a business brings a product to market, it enters a new competitive environment. It is important to analyze your “colleagues”, find their strengths and weaknesses, and then figure out how to take some of their customers for yourself. Any, even a new and unique product, has competition – not necessarily direct, it can be indirect.

The Fourth Step. Formulating A Vision of Prospects and Determining A Strategy for Achieving Them

The most common mistake is fuzzy and complex wording. When shaping the vision, make sure you ask everyone to have his or her say. Feel for and fix the common vector. Think carefully about the scale of the coming changes: it should not shock and stupefy all members of the reform team.

The Fifth Step. Quick Wins

The best practical advice is to include a “miracle” in the plan and make sure it happens! It is necessary to lay down the plan of victories in the strategy and periodically return to it, revise and supplement it. As an example, set short-term achievable goals and publicly reward those who achieve them.

The Sixth Step. Consolidating Gains and Deepening Change

The worst thing you can do is declare victory prematurely after the first major performance improvement. Use the team’s increased confidence after initial successes to adjust systems, structures, and practices that do not fit into the new vision. Hire, promote and train employees who can deliver the vision. Stimulate the process of change by launching new projects and attracting new change agents.

The Seventh Step. Run A Test

Depending on the size of the market and the amount of competition in it, choose an expansion strategy. After getting the first real data, adjust your launch plan and try again until you are ready for a full and big exit to a new field of work.

The Eighth Step. Explore Additional Factors

You need to find out if there are any peculiarities for business at the legislative level in the new market. It will be useful to study the industry media. If you enter foreign markets, order a legal consultation.